Mid-June saw a dramatic escalation of the long simmering conflict between Israel and Iran, with Israel’s air attacks on Iran nuclear facilities and targeting of Iran’s high-ranking military and scientific personnel.

On Saturday Iran reported Israel had attacked two gas fields widening the scope of targets. Israel was reported to have attacked the Phase 14 of South Pars Gas field and Fajr Jam Gas Refining Company Bushehr province.

For the maritime industry, all eyes are on Iran’s terminals in the Arabian Gulf- so far not the targets of Israeli bombings, and on the Straits of Hormuz- at the mouth of the Gulf, where some 20% of the world’s oil cargo transits. Various analysts have pegged Iran crude oil exports at between 1.7 million bpd and 2.0 million bpd, prior to the renewed sanctions in Trump 2.0.

Looming in the background are fears of what might happen. Analysts at Rystad Energy noted that: “If Iran’s retaliation is limited, focusing only on Israeli military sites, as seen in past episodes, price increases may remain contained and temporary. But if Iran escalates by disrupting oil flows through the Strait of Hormuz, attacking regional energy infrastructure, or targeting US military assets, prices could spike much more sharply.”

Rystad offered detailed information on cargo flows, saying that: “Around 12 million barrels per day of crude oil pass through the strait, over 80% of it bound for Asia…Including refined products, the total volume can reach up to 20 million barrels per day.”

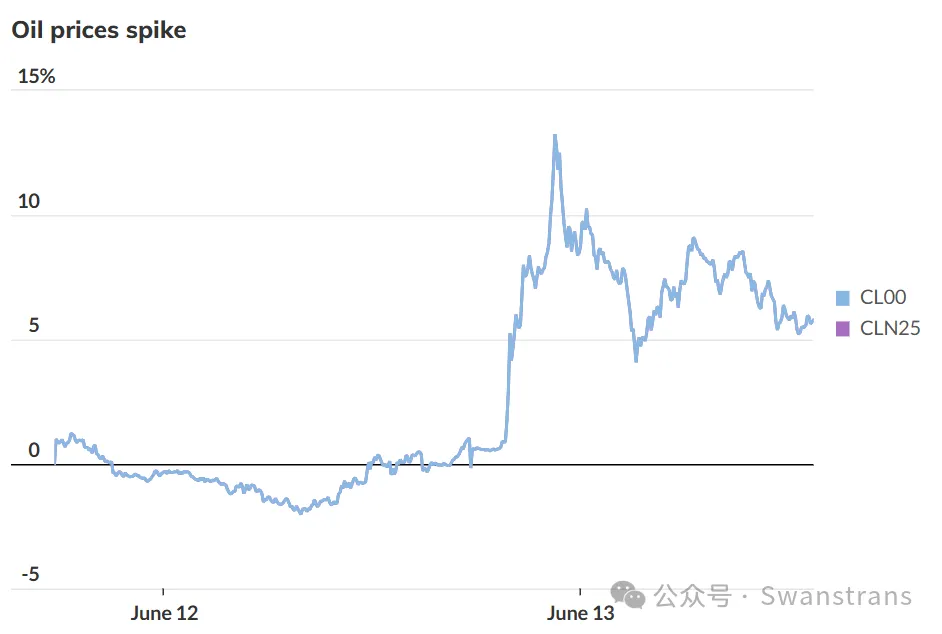

In the first day of the new conflagration, many analysts were offering views on possible impacts on the maritime realm. The instant impact concerns the price of ships’ fuel; in the initial hours following the news of bombings, the price of crude oil had jumped by more than $10 per barrel, though it backed off when traders saw that terminals and Straits were still intact. Nevertheless, the industry is girding for increases in fuel prices- with owners trying to pass these on to cargo shippers where possible.

In the weekly Opinion piece from Poten & Partners, analyst Erik Broekhuizen wrote that: “Similar to the reaction of oil prices, this is a normal development under the circumstances. Rates for the benchmark

Arabian Gulf -East VLCC route increased from WS43 to W55. However, while the increase is significant in percentage terms, the tanker market remains in the summer doldrums.” He described instances of a rush to charter vessels in the wake of previous conflicts in the region but said: “fixing activity has not surged so far and most owners are still willing to bring their tankers into the Arabian Gulf. However, this can change quickly. Stay tuned.”

Tanker giant Frontline (NYSE: FRO) was perhaps in the minority here, with a reported reluctance to offer vessels for loading in the Arabian Gulf. Nevertheless, stock traders, noting the stronger WS numbers, boosted FRO’s stock price by nearly 10% (up to almost $20 per share) following Israel’s bombing - on a day that the overall stock markets saw sharp declines.

In a special edition of its weekly “Energy Exchange” podcast, the Columbia University Center for Global Energy Policy (CGEP), expert Richard Nephew, with extensive experience crafting the US’s Iran policy said that if Israel was focusing on a broad “regime change” objective- going beyond actions directed only at nuclear facilities and capabilities, then: “I think it’s almost inevitable that you’ll see attacks on pipeline infrastructure, oil refineries, production sites…” He continued, alluding to the potential for actions impacting the Straits of Hormuz, “In that environment, the Iranians have been pretty clear…if we can’t export oil, then nobody will.”

A webinar from Dow Jones, “What Israel’s Attack on Iran Means for Business and Markets”, offered a slightly different perspective. Dr. Laura James, a top political analyst at Oxford Analytica, saying that: “The costs to Iran of alienating [the other nations in the Arabian Gulf] are very high.” Dr. James, did caution, however, that if the war continued over weeks and months, “there could be unforeseen consequences, proxy actors in the region could get slightly out of control”.

Oil analyst Carlo Barassa, from Dow Jones subsidiary OPIS, said that a move against the Straits would draw the ire of many nations, and would not be in anybody’s interest- “including that of Iran.” Prices for LNG were also up slightly; Dr. James Stevenson, also from OPIS, pointed to Qatar’s role as a leading LNG exporter, and said that an attack on the Straits would be “massively impactful” on LNG pricing, but that: “It’s not really a base case that [a closure] would happen.”